Oregon Probate Fees in 2017

How Much Does Probate Cost in Portland Oregon?

I have broken down the common court costs and fees that associated with probating an estate in Oregon. For 2017, the uncontested estates that I helped administer ranged from $2632.50 to $4,950.00. In contested estates where the heirs are arguing over the validity of a will or the distribution of property, the costs with be much higher.

Breakdown of Probate Legal Fees

| Service | Cost |

|---|---|

| 2017 Court Filing Fees | $558.00 |

| Publication Fees | $128.00 |

| 2017 Attorney Fee Average (Uncontested Administration) | $4183.59 |

The averages were calculated from estates I helped administer for my clients in Clackamas, Multnomah and Washington Counties.

The size of the estate didn't seem to increase the cost of the administration. Homes in foreclosure and large debts tended to increase the attorney fees the most in uncontested administrations. The estates that didn't have homes in foreclosure averaged closer to $2,500.

Other Costs

By far the largest cost in the majority of probates in Oregon are the realtor fees. I have a previous post that goes more in depth into How Much Does Probate Cost in Oregon if you want to learn more.

2017 Oregon Estate Tax Rates

The State of Oregon levies a tax on taxable estates that have a value of more than $1 Million. Estates of less than $1 Million are exempt from the Oregon Estate Tax. This is a separate from the Federal Estate Tax. In 2017, estates smaller than $5,490,000 are exempt from the Federal Estate tax. The top Federal Estate tax rate is 40%. More information on determining the Federal Estate Tax rates can be found at IRS.gov.

The 2017 Oregon Estate Tax Rates are:

| Taxable Estate Equal to or more than: | Taxable Estate less than: | Tax rate on Taxable Estate amount more than column 1 |

|---|---|---|

| $1,000,000 | $1,500,000 | $0 + 10% |

| 1,500,000 | 2,500,000 | 50,000 + 10.25% |

| 2,500,000 | 3,500,000 | 152,500 + 10.5% |

| 3,500,000 | 4,500,000 | 267,500 + 11% |

| 4,500,000 | 5,500,000 | 367,500 + 11.5% |

| 5,500,000 | 6,500,000 | 482,500 + 12% |

| 6,500,000 | 7,500,000 | 602,500 + 13% |

| 7,500,000 | 8,500,000 | 732,500 + 14% |

| 8,500,000 | 9,500,000 | 872,500 + 15% |

| 9,500,000 | 1,022,500 + 16% |

Oregon Probate Inventory

What is required on an estate inventory.

One of the first tasks must be completed during the administration of an estate is the inventory. The inventory must be completed within 60 (the timeline has been changed to 90 days) days of the appointment of a personal representative and provide estimates of the value of the property as of the date of death.

ORS 113.165 Filing inventory and evaluation

Within 60 days after the date of appointment, unless a longer time is granted by the court, a personal representative shall file in the estate proceeding an inventory of all the property of the estate that has come into the possession or knowledge of the personal representative. The inventory shall show the estimates by the personal representative of the respective true cash values as of the date of the death of the decedent of the properties described in the inventory.

Determining the values of assets is generally straightforward. You can look at the balance of a bank account or investment account at the date of death.

Hiring Appraisers

Sometimes the estate will have unusual or unique property that must be appraised. Oregon law allows the personal representative to hire an appraiser that will be paid by the estate as a necessary expense.

ORS 113.185 Appraisement

(1) The personal representative may employ a qualified and disinterested appraiser to assist the personal representative in the appraisal of any property of the estate the value of which may be subject to reasonable doubt. Different persons may be employed to appraise different kinds of property.

(2) The court in its discretion may direct that all or any part of the property of the estate be appraised by one or more appraisers appointed by the court.

(3) Property for which appraisement is required shall be appraised at its true cash value as of the date of the death of the decedent. Each appraisement shall be in writing and shall be signed by the appraiser making it.

(4) Each appraiser is entitled to be paid a reasonable fee from the estate for services and to be reimbursed from the estate for necessary expenses.

Personal Items and Household Goods.

Generally speaking, it is fine to lump the household goods and personal items together on the inventory. If the items have a substantial value, they should be listed individually on the inventory.

When determining a "substantial value", most attorneys rely on 26 CFR 20.2031-6 - Valuation of household and Personal effects.

(b) Special rule in cases involving a substantial amount of valuable articles. Notwithstanding the provisions of paragraph (a) of this section, if there are included among the household and personal effects articles having marked artistic or intrinsic value of a total value in excess of $3,000 (e.g., jewelry, furs, silverware, paintings, etchings, engravings, antiques, books, statuary, vases, oriental rugs, coin or stamp collections), the appraisal of an expert or experts, under oath, shall be filed with the return. The appraisal shall be accompanied by a written statement of the executor containing a declaration that it is made under the penalties of perjury as to the completeness of the itemized list of such property and as to the disinterested character and the qualifications of the appraiser or appraisers.

Amended and Supplemental Inventories

Occasionally the personal representative will have to correct or add information to the inventory that was filed with the court.

When the information filed with the court was incorrect, the personal representative must file an amended inventory to correct that mistake.

A supplemental inventory is required when the personal representative finds property of the estate after the original inventory has been filed.

Other types of assets

Real estate located outside of Oregon should not placed on the inventory. Certain beneficial interests may or may not be listed on the inventory. You should talk to your attorney if you have any questions regarding beneficial interests.

Basics of an Oregon Estate Plan (Part 3)

Part 3. Advance Care Planning

This is the Third Article in our Basics of Estate Planning series. In this article, we will explain options for health care decision making. We will talk about two documents that allow you to express your wishes when you are not able to. The first are legal documents call advance directives. The second are medical orders call Physicians Orders for Life Sustaining Treatment (POLST.)

Advance Directives

The Oregon Health Care Decisions Act (ORS Chapter 127) allows Oregonians to create Advance Directives for Health Care, Powers of Attorney, Declarations for Mental Health Treatment and other documents. Advance Directives are legal documents.

Healthcare Representatives

Advanced directives allow a person to decide their treatment wishes while they are still able. They also allow you to appoint a healthcare representative to direct your health care when you are unable to do so. You can also place limits on the decisions that your Healthcare Representative can make for you. For example, you may have certain religious or ethical beliefs that you want taken into account when life-sustaining decisions are being made and that your Healthcare Representative should honor your wishes.

Healthcare instructions

Advanced directives also allow you to make decisions about specific medical conditions and treatments. Below is an excerpt from an Advanced Directive:

In this example, you have an Advanced Progressive illness and are very unlikely to substantially improve. Importantly, you are unable to communicate and someone else will have to make medical decisions for you. With the Advance Directive you can choose the care you desire in this situation by initialing the form.

The State of Oregon has information regarding Advance Directives and an Advance Directive form available online (http://www.oregon.gov/DCBS/insurance/shiba/topics/Pages/advancedirectives.aspx)

Physician Order for Life Sustaining Treatment (POLST)

A POLST is an optional form that you create with your health care provider. A POLST is a medical order that must be signed by a health care professional in order to be valid. A POLST is typically used by those that are seriously ill or are near the end of life.

A POLST will tell medical professionals whether you want CPR, tube feeding or any other medical interventions that may sustain life.

Basics of estate planning series

You can review the other articles in this series.

Basics of an Oregon Estate Plan (Part 2)

Part 2. What is a Trust.

This is the second article in our basics of estate planning series. In this article, we will explain what a Revocable Trust is, what it can be used for and what it can’t do.

The first article in the series is Part 1. What is a Will.

What is a Living Trust?

A living trust is simply a contract with yourself. You establish a trust by written agreement and by “funding” the trust by transferring your property into it. The trust will appoint a “trustee” to administer the assets of the trust. The trust agreement will also provide instructions for how the trust is to be administered. A living trust can be a used to avoid Probate or Conservatorship.

How does a Living Trust Work?

By retitling all of your property from yourself to the living trust while you are living and providing instructions for the “successor trustee” to distribute your property after your pass, very little of your property will pass through probate.

A diagram explaining the mechanics of a living trust.

A “Pour Over Will” is often used alongside a living trust to move property into the trust that was missed or was acquired after the trust was formed. A downside of this method is that “Pour Over Will” may have to be settled through a probate proceeding before the assets of the living trust can be distributed. Another option is to transfer the property not included in the living trust directly to the heirs by a small estate proceeding.

How does a Living Trust avoid Conservatorship?

Conservatorship is when the court determines that you are unable to manage your financial affairs and appoints a conservator to do so. By transferring your property to a revocable living trust and providing detailed instructions for the successor trustee in the event you become incapacitated, you can avoid the court oversight and costs involved in a conservatorship.

Drawbacks of a Living Trust.

The main drawbacks of a Revocable Living Trust are:

1. Complexity. Trusts are often left unfunded and property acquired after the formation of the trust is not moved into the trust. Living Trusts require more maintenance and ongoing administration than a will.

2. Costs. Living Trusts are more expensive than creating a will. For young and healthy individuals, the costs of probate and conservatorship are likely many years down the road. For these individuals, they are often times better off investing the money they would have spent setting up a Living Trust. Older individuals will more quickly see the benefits of probate and conservatorship avoidance and may want to consider a living trust.

3. Unforeseen Consequences. Family’s change and the law changes. Companies may want to review the trust documents if you purchase or insure property. Stock in certain corporations may not be held in some trusts without serious tax implications. You may also have difficulty acquiring assets in other Countries.

If would like to learn more about how to plan your estate, visit our practice page or search the blog on the right. You can also sign up for our newsletter and have estate planning tips delivered to your email.

Basics of an Oregon Estate Plan (Part 1)

Part 1. What is a Will.

This is the first article in our basics of estate planning series. In this article, we will explain what a Will is, what it can be used for and what it can’t do.

Part two of our series is Part 2. What is a Living Trust.

What is a Will?

A Will allows someone to decide how they want their assets divided after they have passed away. Any person who is 18 years or older or who has been lawfully married or who has been emancipated, and who is of sound mind, may make a Will.

What happens if I die without a Will in Oregon?

If you die without a Will your assets are distributed according to the laws of Oregon. Inheriting without a Will is called intestate succession and we have an article that diagrams some of the common ways your assets may be distributed. (Intestate Succession in Oregon)

Benefits of a Will.

There are many benefits to creating a Will. At the minimum, a Will should appoint a personal representative and waive bond. A Will can allow you to make a charitable gift, create a testamentary trust for your children, or even provide for your pets.

Formalities of making a Will.

There are several formalities that you need to follow in order to have a valid Will in Oregon. The most important are that they are in writing and that two witnesses watch you sign your Will.

Does a Will avoid probate in Oregon?

A Will does not avoid probate but it can make the administration of probate cheaper and easier. Your Will allows you to appoint a Personal Representative to manage your estate and you will be able to waive bond for the personal representative. Just doing those two things will save your estate money and move your estate through the probate court more quickly.

Elective Share.

While your Will ordinarily controls how you distribute your assets, your spouse has a right to claim part of your estate. You are not required to provide for anyone in your Will and Oregon doesn’t allow anyone to claim a portion of your estate except for your spouse.

I have no money. Should I make a Will?

How you distribute your assets is only part of what your Will does. Your Will also allows you to make arrangements for your minor children.

How do I change my Will?

You can make changes to your Will be adding something called a codicil. A codicil requires the same legal formalities as a creating a Will.

How do I revoke my Will?

Your Will may be revoked by creating another Will or by the physical act of destroying the Will with the intent to revoke it. Certain acts automatically revoke your will. If you get married or divorced, you should consult with an attorney to see how it affects you. Getting married may revoke a previously written Will. Getting divorced in Oregon revokes portions of your Will that benefit your former spouse. If you have or adopt children after executing your Will, your Will may be modified by state law to provide for those children.

If would like to learn more about how to plan your estate, visit our practice page or search the blog on the right. You can also sign up for our newsletter and have estate planning tips delivered to your email.

Duties of an Oregon Personal Representative

You've been appointed the Personal Representative. Now what do you do?

When you are appointed as the personal representative in a will or by the laws of intestate succession, you may and may not be sure what being a personal representative requires.

The duties of a personal representatives are described by statute as:

ORS 114.265, General duties of personal representative

A personal representative is a fiduciary who is under a general duty to and shall collect the income from property of the estate in the possession of the personal representative and preserve, settle and distribute the estate in accordance with the terms of the will and ORS chapters 111, 112, 113, 114, 115, 116 and 117 as expeditiously and with as little sacrifice of value as is reasonable under the circumstances.

In plain English this means that the Personal Representative must:

- Safeguard the property of the decedent’s estate. If it is necessary for property to not be in the possession of the personal representative, then a custody receipt should be used.

- Open a separate estate bank account and deposit all checks and cash of the estate.

- Notify Heirs and Beneficiaries.

- File an inventory of the decedent’s assets with estimated values.

- Determine the creditors of the estate and pay valid claims. If the estate does not have enough money to pay all creditor claims, then the claims will be paid according to priority of claims set out by statute.

- File state and federal income tax returns and pay taxes. Prepare a Federal and State Estate tax return if one is required.

- If the Estate Administration lasts longer than a year, then the personal representative must file an annual inventory with the court.

- Receive court approval before paying fees to the personal representative or before distributing property to the heirs or beneficiaries.

You Can Find More Information

- On our Probate Practice Page.

- Review blog posts about probate.

- Search our website in the box on the right side of the page.

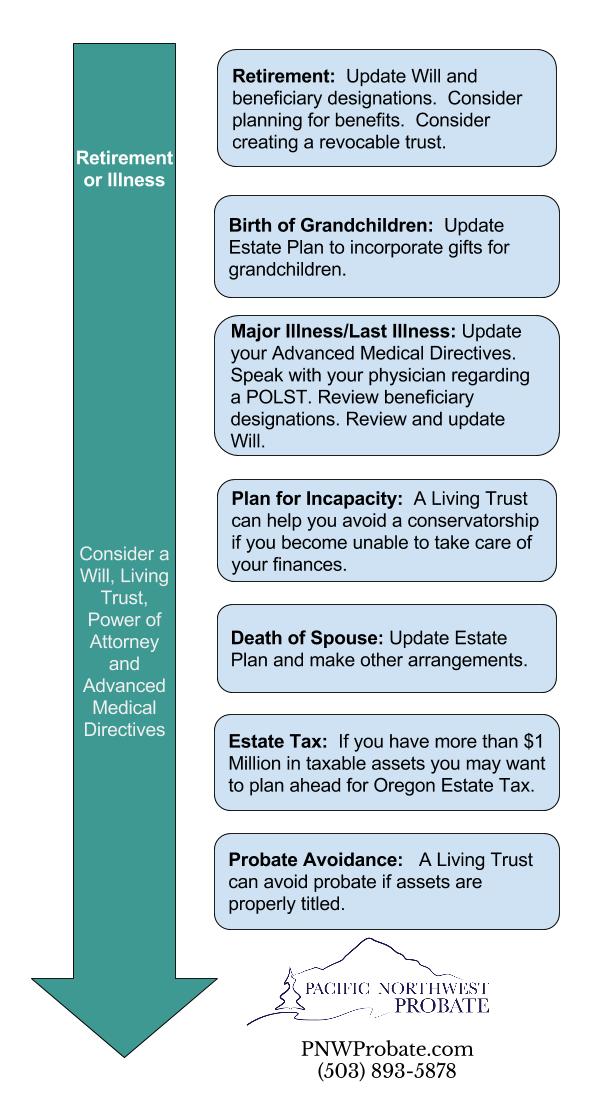

Oregon Estate Planning Timeline

How and When to Plan Your Estate

You can create a will anytime after you turn 18 in Oregon. This timeline gives you some guidance on what you should consider and when.

Many people put off estate planning until later in life. Here are some milestones that you should consider.

Find more information about estate planning:

How Long Does Probate Take in Oregon?

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 5-7 months depending on the nature of the assets and the backlog at the court house.

To speed up the process, I make sure that the Personal Representative is well informed regarding the process and has a plan on how to administer the estate before filing with the court.

I have written about the Probate Process in Oregon and created an Oregon Personal Representative Checklist to help my clients better understand the proceedings. You can also find more information by searching the blog on the right.

Search the blog and learn more about wills and probate in Oregon.

Disclaimer:

Nothing on this blog constitutes individual legal advice or creates an Attorney-Client relationship.

-

May 2023

- May 8, 2023 What is a Limited Judgment Appointing Personal Representative? May 8, 2023

- May 1, 2023 Where should I keep estate planning documents? May 1, 2023

-

April 2023

- Apr 24, 2023 How do I talk to my elderly parents about estate planning? Apr 24, 2023

- Apr 17, 2023 How do I get started in estate planning? Apr 17, 2023

- Apr 10, 2023 What questions should I ask my estate planning attorney? Apr 10, 2023

- Apr 5, 2023 Giving Appreciated Property to Charity in Oregon Apr 5, 2023

- Apr 3, 2023 How often should an estate plan or will be updated or reviewed? Apr 3, 2023

-

March 2023

- Mar 30, 2023 Is real property located outside of Oregon subject to the Oregon estate tax? Mar 30, 2023

- Mar 29, 2023 How do I find out who the personal representative of an estate is? Mar 29, 2023

- Mar 27, 2023 Why is estate planning so expensive? Mar 27, 2023

- Mar 23, 2023 Can non-residents be subject to the Oregon Estate Tax? Mar 23, 2023

- Mar 22, 2023 How do I sue a personal representative? Mar 22, 2023

- Mar 20, 2023 What are some estate planning steps that can ease financial burdens following the death of a loved one? Mar 20, 2023

- Mar 16, 2023 What is a credit shelter trust? Mar 16, 2023

- Mar 15, 2023 Who is the personal representative of an intestate estate? Mar 15, 2023

- Mar 13, 2023 How does a probate or personal representative bond work? Mar 13, 2023

- Mar 9, 2023 Does Oregon have a gift tax? Mar 9, 2023

- Mar 8, 2023 How can I leave money to my son but not his wife? Mar 8, 2023

- Mar 6, 2023 What is a power of attorney? Mar 6, 2023

- Mar 2, 2023 What is the importance of a schedule K-1 for an estate? Mar 2, 2023

- Mar 1, 2023 Overview of the Oregon Estate Tax Mar 1, 2023

- Mar 1, 2023 Oregon Estate Tax and the Fractional Formula Mar 1, 2023

- Mar 1, 2023 Can My Mother Leave Me Out of Her Will? Mar 1, 2023

-

February 2023

- Feb 27, 2023 What is a pour-over will? Feb 27, 2023

- Feb 24, 2023 How to remove squatters from a deceased person's home. Feb 24, 2023

- Feb 20, 2023 How can a revocable trust avoid a conservatorship? Feb 20, 2023

- Feb 17, 2023 A dead person owes me money, how do I file a claim? Feb 17, 2023

- Feb 16, 2023 What are the Oregon inheritance or succession laws? Feb 16, 2023

- Feb 13, 2023 What is a "revocable trust" or "living trust"? Feb 13, 2023

- Feb 6, 2023 Can property be transferred without probate? Feb 6, 2023

-

January 2023

- Jan 30, 2023 What happens to a bank account when someone dies without a beneficiary? Jan 30, 2023

- Jan 23, 2023 What is a Payable on Death bank account? Jan 23, 2023

- Jan 17, 2023 What happens if I don’t go through probate? Jan 17, 2023

- Jan 9, 2023 Does Oregon have a Transfer on Death deed? Jan 9, 2023

- Jan 2, 2023 What Triggers Probate in Oregon? Jan 2, 2023

- Jan 1, 2023 What is the 65 day rule for estates and trusts? Jan 1, 2023

-

May 2022

- May 10, 2022 Can a Will Avoid Probate? May 10, 2022

-

April 2022

- Apr 25, 2022 How Do You Avoid Probate in Oregon? Apr 25, 2022

- Apr 7, 2022 Must an Estate Go Through Probate in Oregon? Apr 7, 2022

-

March 2022

- Mar 28, 2022 How much does an estate have to be worth to go to probate in Oregon? Mar 28, 2022

-

September 2021

- Sep 3, 2021 We are closed for Labor Day. Sep 3, 2021

- Sep 2, 2021 How Long Does Probate Take in Oregon? (Updated for COVID) Sep 2, 2021

- Sep 2, 2021 How does probate work without a will in Oregon. Sep 2, 2021

-

January 2018

- Jan 18, 2018 2018 Oregon Estate Tax Rates Jan 18, 2018

- Jan 18, 2018 Is a Handwritten Will Valid in Oregon? Jan 18, 2018

-

December 2017

- Dec 18, 2017 Oregon Probate Fees in 2017 Dec 18, 2017

-

August 2017

- Aug 2, 2017 2017 Oregon Estate Tax Rates Aug 2, 2017

-

March 2017

- Mar 9, 2017 Oregon Probate Inventory Mar 9, 2017

-

November 2016

- Nov 26, 2016 Basics of an Oregon Estate Plan (Part 3) Nov 26, 2016

- Nov 8, 2016 Basics of an Oregon Estate Plan (Part 2) Nov 8, 2016

- Nov 1, 2016 Basics of an Oregon Estate Plan (Part 1) Nov 1, 2016

-

October 2016

- Oct 24, 2016 Duties of an Oregon Personal Representative Oct 24, 2016

-

September 2016

- Sep 6, 2016 Oregon Estate Planning Timeline Sep 6, 2016

-

June 2016

- Jun 23, 2016 How Long Does Probate Take in Oregon? Jun 23, 2016

- Jun 20, 2016 How to File for Probate in Oregon Jun 20, 2016

-

May 2016

- May 17, 2016 When is Probate required in Oregon? May 17, 2016

- May 6, 2016 Oregon Probate Bond May 6, 2016

- May 5, 2016 Oregon Personal Representative Checklist May 5, 2016

- May 3, 2016 Compensation of Personal Representative in Oregon May 3, 2016

-

April 2016

- Apr 29, 2016 2016 Oregon Estate Tax Rates Apr 29, 2016

- Apr 25, 2016 Probating Joint Bank Accounts in Oregon Apr 25, 2016

- Apr 19, 2016 How much does Probate cost in Oregon? Apr 19, 2016

-

March 2016

- Mar 3, 2016 What is a Guardianship in Oregon? Mar 3, 2016

-

February 2016

- Feb 26, 2016 Elements of an Oregon Estate Plan Feb 26, 2016

- Feb 24, 2016 Faith Based Estate Planning in Oregon Feb 24, 2016

- Feb 23, 2016 March Events Feb 23, 2016

- Feb 16, 2016 Self-Made Rich are more Generous Feb 16, 2016

- Feb 10, 2016 What Happens to assets if an Estate isn't Probated in Oregon? Feb 10, 2016

- Feb 8, 2016 Oregon Probate Jurisdiction Feb 8, 2016

- Feb 5, 2016 Do You Really Want to Die Rich? Feb 5, 2016

- Feb 4, 2016 2016 Oregon Legislation to watch Feb 4, 2016

- Feb 2, 2016 Probate Pitfalls (Investing Estate Assets) Feb 2, 2016

-

January 2016

- Jan 14, 2016 Intestate Succession in Oregon Jan 14, 2016

- Jan 13, 2016 Estate Planning for Unmarried Seniors Jan 13, 2016

- Jan 12, 2016 What does an Oregon Probate Attorney do? Jan 12, 2016

-

December 2015

- Dec 31, 2015 End of Life Decision Making in Oregon Dec 31, 2015

- Dec 21, 2015 Free Oregon Estate Planning Workshop Dec 21, 2015

- Dec 17, 2015 Non-borrowing surviving spouse can retain home subject to Reverse mortgage Dec 17, 2015

- Dec 3, 2015 Estate Planning for Digital Assets Dec 3, 2015

-

October 2015

- Oct 29, 2015 2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy Oct 29, 2015

- Oct 21, 2015 End of Year Estate Planning Oct 21, 2015

- Oct 12, 2015 Disinheriting Parents in Oregon Oct 12, 2015

- Oct 1, 2015 Inheriting Property when there is no Will. Oct 1, 2015

-

September 2015

- Sep 29, 2015 Negative Wills in Oregon Sep 29, 2015

- Sep 25, 2015 2016 Oregon Probate Law Modernization Sep 25, 2015

- Sep 21, 2015 The Probate Process in Oregon Sep 21, 2015

- Sep 15, 2015 2015 Oregon Estate Tax Rates Sep 15, 2015