Intestate Succession in Oregon

What happens when you die without a will

When a person dies without a Will in place, the Oregon Probate Law (Intestate Succession and Wills) determines how that person’s estate will be distributed. The diagrams below will help you understand how the estate will be divided. This is not a complete list of scenarios but should give you a good idea of what can happen. In real life, families can be incredibly complicated and who inherits what can be equally as complicated.

Surviving Spouse and Children

No Surviving Spouse and Surving Children

When there is no surviving spouse, the Estate is distributed evenly between the children.

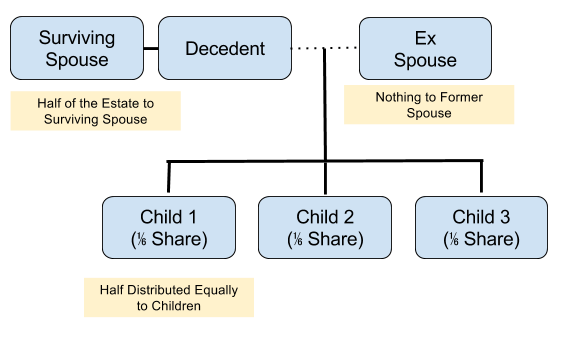

Children from a Previous relationship and a surviving spouse

In this situation, the surviving spouse receives half of the estate while the Decedent’s children receive the other half distributed evenly. Former spouse receives nothing.

Parents Share when Decedent has no children or spouse

When a Decedent passes with no Spouse or Children, the surviving Parent will inherit the estate.

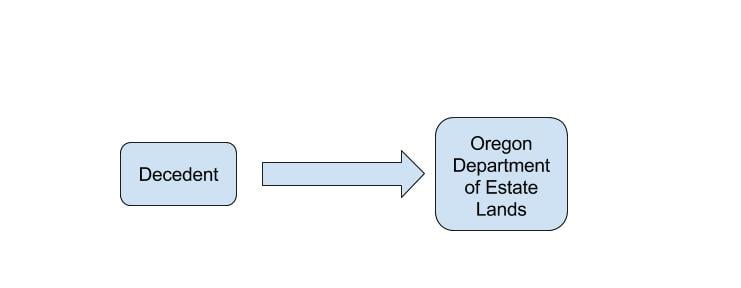

No Heirs, unable to locate heirs or heirs refuse

Caveats

There are many other situations that can arise with families. For example, parents can sometimes forfeit their share of estate because of neglect or abuse. If the heir murdered or abused the person who died, Oregon law can prevent them from inheriting property. There are also rules for grandparents inheriting property and for individuals inheriting property to two lines of relationships.

What appears first as simple can quickly become complicated when blended families, remarriages, not remarrying and other decisions we make throughout life get added to the mix.You can learn more about Oregon Probate on my practice area page.

If you have any questions on how your property will be inherited after you pass, feel free to contact me.

Estate Planning for Unmarried Seniors

About once a week I hear from unmarried seniors living together. Typically they have been living together for about a decade and are previously divorced or widowed. They had a reason not to get married at the time but one of them has now passed and the ownership of property is in question.

There are many reasons why people don't want to get married (finances, bad previous marriages, etc.) but marriage does confer certain rights of inheritance. In the absence of a Will, Oregon's intestacy laws will determine who inherits. This can lead to the surviving partner losing their home because they were not on the title.

Substituted Decision Making

Unmarried couples are also unable to make financial and healthcare decisions for their partners. Durable power of attorneys, healthcare power of attorneys, and certain types of trust can help you make decisions and care for your partner if they are to become incapacitated.

Making sure Children are taken care of too

Trusts can be used to make sure that your surviving partner has the means to support themselves and, when they pass, your children still inherit they way you wanted.

Marriage has Consequences

When you marry your spouse, your legal status changes and you acquire new legal rights. The decision not to marry also has consequences and may lead to unintended consequences as you age. At the very least, you should talk to your partner on how you want your property handled after your death. If necessary, you should draw up estate planning documents to make sure your wishes are upheld.

What does an Oregon Probate Attorney do?

A probate attorney advises a personal representative and help guide them through the probate process. While the steps of administering a probate estate in Oregon initially appear simple, there are many opportunities for mistakes and for malpractice.

A large part of the job of a probate lawyer is to understand the nature of the assets of decedent. Do they belong in the probate estate or do they pass outside of probate? Are the assets located in Oregon or another state? If they are located in another state, the Personal Representative may have to administer an ancillary probate in that state.

Because the probate process in Oregon is court administered, filing with the court and requesting court permission takes up much of a probate attorney's time. While personal representatives sometimes have an adversarial view of court administration, the State of Oregon has passed these legal requirements in order to protect the deceased, their heirs and anyone who may have had financial dealings with them.

If you have any questions regarding what a probate attorney does, please feel free to contact me.

End of Life Decision Making in Oregon

End-of-life decision making is an emotionally fraught time for those that are dying and their families. At some point in our lives, everyone faces the death of a loved one. The trauma of these deaths can last for many years after their passing. Because of the advances in modern medicine, many more lives are saved and many more people are living longer and healthier lives. The downside of this improved healthcare is that many people now linger in ways that were unimaginable a generation or two ago.

This has created a new set of burdens for the dying and their families. Individuals want their end-of-life wishes followed and die in a manner consistent with their beliefs and values. Families want to know that they made the right decisions for their loved ones.

How People die in Oregon

The vast majority of Oregonians die of natural causes. According to the Oregon Health Authority, 34,160 Oregonians died in 2014. Of those, 31,395 (91.9%) died of natural causes. Seventy-five percent of the deaths (25,702) were for Oregonians aged 65 or older.

For 2012, the CDC broke down the Causes of Death further:

Nationally the numbers are the similar. Most deaths occur in those 65 and older any many die in hospital settings.

How people want to die

The majority of Americans want to die at home. Survey after survey has found that. Unfortunately, that is not how most Americans die: 63% of Americans die in hospitals and 17% die in long term care facilities. In 2010, the average hospital stay that resulted in death was 7.9 days. (CDC) Oregonians average of 5.2 days in the hospital before death in 2013.

What do Americans fear most about dying?

People fear that their pain, symptoms, anxiety, emotional suffering, and family concerns will be ignored. Many critically ill people who die in hospitals still receive unwanted distressing treatments and have prolonged pain. Many fear that their wishes (advance directives) will be disregarded and that they will face death alone and in misery. Physicians may use confusing or vague medical terms and talk briefly about treatment options when the patients are too sick to participate. Most people want to discuss advance directives when they are healthy and often want their families involved. (American Psychological Association End of Life Factsheet)

If Americans want to die at home, then why do so many end up dying in the ICU?

Effect of End of life decision making on families

The stress of end of life takes a tremendous toll on families and healthcare surrogates (someone who makes medical decisions for you.) For those who were healthcare surrogates that made medical decisions when love ones were in the ICU, one third had symptoms of Posttraumatic Stress Disorder (PTSD.) Eighty-two percent of those who had to make end of life decisions had symptoms of PTSD. (Surviving Surrogate Decision-Making: What Helps and Hampers the Experience of Making Medical Decisions for Others)

Now compare this to the lifetime rate of PTSD symptoms in the American Military. The lifetime rate of PTSD for Vietnam Veterans is 31% and the rate for Afghanistan/Iraq veterans is 14%. (Veterans and PTSD)

Surviving spouses and other caregivers also have decreased life expectancy after the death when hospice and other palliative measures are not used. (PUBMED.) The burden of this decision-making and the negatives outcomes for family members can be lessened when family’s discuss end-of-life decisions before they are need and by creating Advanced directives.

How to Resolve

What is quality of life while dying and what is a good death? Most people want to die quickly, painlessly and in their sleep but that is not always the case. People often assume that loved-ones know their wishes and never talk to them regarding it. Don’t assume that your individual values and wishes are known by your loved ones.

Advanced Medical Directives

The Oregon Health Care Decisions Act (ORS Chapter 127) allows Oregonians to create Advance Directives for Health Care, Powers of Attorney, Declarations for Mental Health Treatment and other documents.

Healthcare Representatives

Advanced directives allow a person to decide their treatment wishes while they are still able. They also allow you to appoint a healthcare representative to direct your health care when you are unable to do so. You can also place limits on the decisions that your Healthcare Representative can make for you. For example, you may have certain religious or ethical beliefs that you want taken into account when life-sustaining decisions are being made and that your Healthcare Representative should honor your wishes.

Healthcare instructions

Advanced directives also allow you to make decisions about specific medical conditions and treatments. Below is an excerpt from an Advanced Directive:

In this example, you have an Advanced Progressive illness and are very unlikely to substantially improve. Importantly, you are unable to communicate and someone else will have to make medical decisions for you. With the Advance Directive you can choose the care you desire in this situation by initialing the form.

The State of Oregon has information regarding Advance Directives and an Advance Directive form available online.

If you have any questions regarding end-of-life decisions, please discuss with your family, your physician and, if necessary, with your attorney.

Free Oregon Estate Planning Workshop

January 6, 2016

6:30 PM

Oak Lodge Library

16201 SE McLoughlin Blvd

Oak Grove, OR 97267

Learn the basics of Estate Planning, End of Life Decision Making and Asset Protection from Attorneys Kevin Spence and Michael D. O'Brien. The Workshop is free and open to the public. However, space is limited so please reserve your spot in advance.

Please register by filling out the form below.

Non-borrowing surviving spouse can retain home subject to Reverse mortgage

Reverse Mortgages were marketed to provide cash to older Americans during their retirement by borrowing against the equity in their homes. The payments were generally based on the life expectancy of the borrower. In order to maximize payments, some couples would transfer the property to the older of the two so that the payments would be higher. The older spouse dies and that is how we end up with a non-borrowing surviving spouse living in a property subject to a reverse mortgage.

Because of how Reverse Mortgages are written and regulated, the Garn St. Germain Act's prohibition wasn't applicable. (Garn St. Germain generally prohibits a lender from calling a mortgage on the death of the borrower.) This ended with many surviving spouses at risk of losing their homes.

The US Department of Housing and Urban Development (HUD) clarified this with Mortgagee Letter 2015-15 this summer. This letter allows the Mortgagee (Lender) to do two things:

“Mortgagee Optional Election (MOE) Assignment” means the optional assignment elected by a mortgagee for an eligible HECM assigned an FHA Case Number prior to August 4, 2014, and associated with an Eligible Surviving Non-Borrowing Spouse.

and

“Mortgagee Optional Election Assignment Deferral Period” means the period of time following the death of the last surviving borrower for an eligible HECM assigned an FHA Case Number prior to August 4, 2014 and associated with an Eligible Surviving Non-Borrowing Spouse during which the due and payable status of a HECM is further deferred based on the continued satisfaction of the requirements for an Eligible Surviving Non-Borrowing Spouse under this Mortgagee Letter and all other FHA requirements.

How is a non-Borrowing spouse defined:

“Eligible Surviving Non-Borrowing Spouse” means a Non-Borrowing Spouse of a HECM borrower where the HECM was assigned an FHA Case Number prior to August 4, 2014 and who:

1. Was either: a. legally married - as determined by the law of the state in which the spouse and borrower reside(d) or the state of celebration - to the HECM borrower at the time of loan closing and who remained married to the HECM borrower until the HECM borrower’s death; or

b. engaged in a committed relationship with the borrower akin to marriage but was prohibited, at the time of HECM loan origination, from legally marrying the HECM borrower based on the gender of both the borrower and Non-Borrowing Spouse, but was legally married prior to the death of the borrower, as determined by the law of the state in which the spouse and borrower reside(d) or the state of celebration, to the HECM borrower and remained married until the death of the borrowing spouse;

2. Currently resides and resided in the property secured by the HECM as his or her principal residence at origination of the HECM and throughout the duration of the HECM borrower’s life; and

3. Who has or is able to obtain - within 90 days following the death of the last surviving borrower - good, marketable title to the property or a legal right (e.g., executed lease, court order, etc.) to remain in the property for life.

What this means is that Mortgage companies have the option of allowing surviving spouses to remain in their homes.

Estate Planning for Digital Assets

What's Going to Happen to My Account When I Die?

As more and more of our life has gone online, the become harder to access all of the information that has been created online during your lifetime. Facebook accounts, Paperless Documents (Bank Statements, Brokerage accounts, Utility Bills, etc), GMAIL accounts and many other online services that make up our day-to-day modern life are all governed by the “Terms of Use” agreements that we all agree to --but rarely read-- when we signup for an account.

More than money, these accounts often contain sentimental correspondence or the only copy of photos. Maintaining and ensuring access to those materials can mean a lot to your loved ones after you’ve passed.

As part of your Estate Plan, you should consider drafting instructions for the Personal Representative appointed in your Will. Things to consider when creating a plan for your Digital Assets.

- Identify the online accounts you and each companies' Terms-of-Service handles the account when you die.

- Compile a list of login and passwords for each account that you want your Personal Representative to have access. Keep this list updated when passwords change and keep it in a secure location.

- Provide instructions for the Personal Representative for each account. Do you want the account deleted, downloaded to a hard disk or kept online as a memorial?

- You may also want to update your Power of Attorney so that they may be able to access your accounts in the event that you become incapacitated.

It is also a good practice to backup photographs that are store online from time to time so that there will be a copy available just in case.

Below are links to the major online companies and how they handle the death of a customer.

What is going to happen to your Facebook account when you die?

Much like our physical assets, our digital assets will have meaning to those we have left behind. We should all take the time to plan how we want them maintained after we have passed.

2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy

The new budget deal is bringing an end to the "File-and-Suspend" strategy (or loophole) to maximize Social Security Benefits in retirement.

End of Year Estate Planning

It’s approaching the end of the year and time to begin reflecting on the changes of the past year. With the end of 2015 upon us and 2016 about to begin, it’s time to get organized. Updating (or creating) your estate planning documents is the final step of the process. First thing you need to do is Get Organized:

- Talk to your family about your wishes

- Review beneficiary designations and make sure they are up to date

- Military and VA documents (get a copy of your DD214)

- Government benefits

- Employment documents

- Pension and savings accounts

Once you have a good idea of what you have and what you want, think about what has changed for your family in the past year:

- Marriages

- Divorces

- New Children/Grand Children/adoption

- Guardians and Conservators for minor children

- Children becoming Adults

- Retirement plans

- Family members with special needs

- Major purchases (especially Real Estate)

Review what you have and make sure it’s up to date.

- Advanced medical directives

- Powers of attorney

- Write a will or living trust

- Make sure your living trust is funded and up to date

There is no reason to wait to the beginning or end of the year to start thinking about Estate Planning but that's when most people reflect on the past year and make the to do list for the next.

Search the blog and learn more about wills and probate in Oregon.

Disclaimer:

Nothing on this blog constitutes individual legal advice or creates an Attorney-Client relationship.

-

May 2023

- May 8, 2023 What is a Limited Judgment Appointing Personal Representative? May 8, 2023

- May 1, 2023 Where should I keep estate planning documents? May 1, 2023

-

April 2023

- Apr 24, 2023 How do I talk to my elderly parents about estate planning? Apr 24, 2023

- Apr 17, 2023 How do I get started in estate planning? Apr 17, 2023

- Apr 10, 2023 What questions should I ask my estate planning attorney? Apr 10, 2023

- Apr 5, 2023 Giving Appreciated Property to Charity in Oregon Apr 5, 2023

- Apr 3, 2023 How often should an estate plan or will be updated or reviewed? Apr 3, 2023

-

March 2023

- Mar 30, 2023 Is real property located outside of Oregon subject to the Oregon estate tax? Mar 30, 2023

- Mar 29, 2023 How do I find out who the personal representative of an estate is? Mar 29, 2023

- Mar 27, 2023 Why is estate planning so expensive? Mar 27, 2023

- Mar 23, 2023 Can non-residents be subject to the Oregon Estate Tax? Mar 23, 2023

- Mar 22, 2023 How do I sue a personal representative? Mar 22, 2023

- Mar 20, 2023 What are some estate planning steps that can ease financial burdens following the death of a loved one? Mar 20, 2023

- Mar 16, 2023 What is a credit shelter trust? Mar 16, 2023

- Mar 15, 2023 Who is the personal representative of an intestate estate? Mar 15, 2023

- Mar 13, 2023 How does a probate or personal representative bond work? Mar 13, 2023

- Mar 9, 2023 Does Oregon have a gift tax? Mar 9, 2023

- Mar 8, 2023 How can I leave money to my son but not his wife? Mar 8, 2023

- Mar 6, 2023 What is a power of attorney? Mar 6, 2023

- Mar 2, 2023 What is the importance of a schedule K-1 for an estate? Mar 2, 2023

- Mar 1, 2023 Overview of the Oregon Estate Tax Mar 1, 2023

- Mar 1, 2023 Oregon Estate Tax and the Fractional Formula Mar 1, 2023

- Mar 1, 2023 Can My Mother Leave Me Out of Her Will? Mar 1, 2023

-

February 2023

- Feb 27, 2023 What is a pour-over will? Feb 27, 2023

- Feb 24, 2023 How to remove squatters from a deceased person's home. Feb 24, 2023

- Feb 20, 2023 How can a revocable trust avoid a conservatorship? Feb 20, 2023

- Feb 17, 2023 A dead person owes me money, how do I file a claim? Feb 17, 2023

- Feb 16, 2023 What are the Oregon inheritance or succession laws? Feb 16, 2023

- Feb 13, 2023 What is a "revocable trust" or "living trust"? Feb 13, 2023

- Feb 6, 2023 Can property be transferred without probate? Feb 6, 2023

-

January 2023

- Jan 30, 2023 What happens to a bank account when someone dies without a beneficiary? Jan 30, 2023

- Jan 23, 2023 What is a Payable on Death bank account? Jan 23, 2023

- Jan 17, 2023 What happens if I don’t go through probate? Jan 17, 2023

- Jan 9, 2023 Does Oregon have a Transfer on Death deed? Jan 9, 2023

- Jan 2, 2023 What Triggers Probate in Oregon? Jan 2, 2023

- Jan 1, 2023 What is the 65 day rule for estates and trusts? Jan 1, 2023

-

May 2022

- May 10, 2022 Can a Will Avoid Probate? May 10, 2022

-

April 2022

- Apr 25, 2022 How Do You Avoid Probate in Oregon? Apr 25, 2022

- Apr 7, 2022 Must an Estate Go Through Probate in Oregon? Apr 7, 2022

-

March 2022

- Mar 28, 2022 How much does an estate have to be worth to go to probate in Oregon? Mar 28, 2022

-

September 2021

- Sep 3, 2021 We are closed for Labor Day. Sep 3, 2021

- Sep 2, 2021 How Long Does Probate Take in Oregon? (Updated for COVID) Sep 2, 2021

- Sep 2, 2021 How does probate work without a will in Oregon. Sep 2, 2021

-

January 2018

- Jan 18, 2018 2018 Oregon Estate Tax Rates Jan 18, 2018

- Jan 18, 2018 Is a Handwritten Will Valid in Oregon? Jan 18, 2018

-

December 2017

- Dec 18, 2017 Oregon Probate Fees in 2017 Dec 18, 2017

-

August 2017

- Aug 2, 2017 2017 Oregon Estate Tax Rates Aug 2, 2017

-

March 2017

- Mar 9, 2017 Oregon Probate Inventory Mar 9, 2017

-

November 2016

- Nov 26, 2016 Basics of an Oregon Estate Plan (Part 3) Nov 26, 2016

- Nov 8, 2016 Basics of an Oregon Estate Plan (Part 2) Nov 8, 2016

- Nov 1, 2016 Basics of an Oregon Estate Plan (Part 1) Nov 1, 2016

-

October 2016

- Oct 24, 2016 Duties of an Oregon Personal Representative Oct 24, 2016

-

September 2016

- Sep 6, 2016 Oregon Estate Planning Timeline Sep 6, 2016

-

June 2016

- Jun 23, 2016 How Long Does Probate Take in Oregon? Jun 23, 2016

- Jun 20, 2016 How to File for Probate in Oregon Jun 20, 2016

-

May 2016

- May 17, 2016 When is Probate required in Oregon? May 17, 2016

- May 6, 2016 Oregon Probate Bond May 6, 2016

- May 5, 2016 Oregon Personal Representative Checklist May 5, 2016

- May 3, 2016 Compensation of Personal Representative in Oregon May 3, 2016

-

April 2016

- Apr 29, 2016 2016 Oregon Estate Tax Rates Apr 29, 2016

- Apr 25, 2016 Probating Joint Bank Accounts in Oregon Apr 25, 2016

- Apr 19, 2016 How much does Probate cost in Oregon? Apr 19, 2016

-

March 2016

- Mar 3, 2016 What is a Guardianship in Oregon? Mar 3, 2016

-

February 2016

- Feb 26, 2016 Elements of an Oregon Estate Plan Feb 26, 2016

- Feb 24, 2016 Faith Based Estate Planning in Oregon Feb 24, 2016

- Feb 23, 2016 March Events Feb 23, 2016

- Feb 16, 2016 Self-Made Rich are more Generous Feb 16, 2016

- Feb 10, 2016 What Happens to assets if an Estate isn't Probated in Oregon? Feb 10, 2016

- Feb 8, 2016 Oregon Probate Jurisdiction Feb 8, 2016

- Feb 5, 2016 Do You Really Want to Die Rich? Feb 5, 2016

- Feb 4, 2016 2016 Oregon Legislation to watch Feb 4, 2016

- Feb 2, 2016 Probate Pitfalls (Investing Estate Assets) Feb 2, 2016

-

January 2016

- Jan 14, 2016 Intestate Succession in Oregon Jan 14, 2016

- Jan 13, 2016 Estate Planning for Unmarried Seniors Jan 13, 2016

- Jan 12, 2016 What does an Oregon Probate Attorney do? Jan 12, 2016

-

December 2015

- Dec 31, 2015 End of Life Decision Making in Oregon Dec 31, 2015

- Dec 21, 2015 Free Oregon Estate Planning Workshop Dec 21, 2015

- Dec 17, 2015 Non-borrowing surviving spouse can retain home subject to Reverse mortgage Dec 17, 2015

- Dec 3, 2015 Estate Planning for Digital Assets Dec 3, 2015

-

October 2015

- Oct 29, 2015 2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy Oct 29, 2015

- Oct 21, 2015 End of Year Estate Planning Oct 21, 2015

- Oct 12, 2015 Disinheriting Parents in Oregon Oct 12, 2015

- Oct 1, 2015 Inheriting Property when there is no Will. Oct 1, 2015

-

September 2015

- Sep 29, 2015 Negative Wills in Oregon Sep 29, 2015

- Sep 25, 2015 2016 Oregon Probate Law Modernization Sep 25, 2015

- Sep 21, 2015 The Probate Process in Oregon Sep 21, 2015

- Sep 15, 2015 2015 Oregon Estate Tax Rates Sep 15, 2015