How to File for Probate in Oregon

The first step of the Probate Process in Oregon is to file a petition for the appointment of a personal representative and probate of a will. The steps for filing with the Probate Court are:

- Gather Documents. This includes Wills and other Estate Planning Documents. You will also want to look for financial documents that may determine whether the property is subject to probate.

- Petition the Court. You will file a petition with the Probate Court asking to be appointed the Personal Representative and to admit the Will, if any.

- Judgment appointing Personal Representative. The Probate Court will enter a judgment based on your petition and on the Will appointing you (the petitioner) as the Personal Representative.

- Issuance of Letters Testamentary or Letters of Administration. The Probate Court Clerk will issue the Letters Testamentary or Letters of Administration after the Probate Court has entered its judgement.

Depending on your circumstances, the petition can be very complicated or very straight forward.

When is Probate required in Oregon?

Do I have to file for probate in Oregon?

Probate is not always needed or desirable when someone dies in Oregon. There are instances when property transfers without having to go to court. Other times, probate is the only way to transfer the property from the person who died to the heirs.

When is Probate needed?

To transfer property or real estate that is titled in the deceased person. This is most common when there is real estate that is titled only in the name of the deceased person but may also be need when there are bank accounts and investment accounts.

To resolve conflicts among the heirs. The children and family of the deceased person may not agree about the authenticity of the will or may have other issues involving the estate.

To collect debts and enforce other rights. People may owe the deceased person money or have other obligations that can be enforced by the personal representative of the estate.

When is Probate not needed?

There are no assets or the assets are not titled.

Transfer-On-Death and Payable-On-Death selections were made and the assets were transferred to the beneficiary automatically.

The property was jointly owned and transferred to the co-owner automatically at death.

If you have more questions about the Probate Process in Oregon you can read articles in the blog, visit our Probate practice or ask me a question.

Oregon Probate Bond

What are Probate Bonds?

A probate bond is a bond issued to protect the heirs and creditors of an estate from the negligence or dishonesty of a personal representative. A personal representative may have sloppy bookkeeping or does not properly and timely deal with claims of the estate. Less often, the personal representative may act dishonestly and steal the assets or gamble them away. In these situations a bond will protect the heirs and creditors from the loss.

When are Probate Bonds Required in Oregon?

ORS 113.105 describes the necessity and amount of bond. Generally speaking, if a will says that no bond shall be required or if the personal representative is the sole heir or devisee no bond will be required.

If the will requires a bond, or doesn't mention bonding, or if the person died without a will and has multiple heirs, the court will require that a bond be filed with the court before letters of administration or testamentary are issued.

The court also has discretion to require a bond even if the will says no bond is necessary.

How Large of a Probate Bond will be Required?

The court looks at three things in order to determine the amount of bond:

- The nature, liquidity and apparent value of the assets of the estate.

- The anticipated income during administration.

- The probable indebtedness and taxes.

The court is required by statute to ensure that the bond is adequate to protect interested persons of the estate.

Qualifying for a Bond.

The bond will be issued to the personal representative by a surety company authorized to transact surety business in this state. The surety company will look at the personal representatives credit report and assets when deciding the amount the personal representative qualifies for.

If the personal representative doesn't qualify for bond required by the court, other options have to be explored.

- Finding a personal representative that does qualify for the bond. This can be done by having the personal representative nominated in the will or preferred by statute decline to serve.

- Restricting estate assets. Typically the real estate (houses) of the deceased are listed as restricted in the petition. This restriction prevents the real estate from being sold without a court order. Because real estate is usually the largest asset of the estate, this will reduce the bond greatly.

- Waiver of Bond by interested parties. The court may, in its discretion, "waive the requirement of a bond if all devisees and heirs known to the court agree in writing that the requirement be waived and the signed agreement is filed with the court at the time of filing of the petition for the appointment of a personal representative." ORS 113.105(4)

If you have any additional questions regarding bonding or probate in general, search the blog in the box on the right or feel free to contact me.

Oregon Personal Representative Checklist

What to do when someone dies in Oregon.

The death of a loved one is a trying time for all families. There are several items that should be found and steps taken so that the transition will be easier.

Documents

Will, Trusts or any estate planning documents of the deceased. A Will must be submitted to the court in order to admit the Will to probate and to appoint the Personal Representative. You can find more information about the Probate Process in Oregon and other probate topics on the blog.

Life Insurance Policies. Up-to-date originals of the policies may be needed to claim the proceeds of the policy.

Car Titles. Titles to any automobiles, boats, trailers or any other vehicle that the deceased may have owned.

Deeds. Any document that proves ownership of real estate. If it's necessary, you can obtain these from your local county.

Stock, Bond or Deposit Certificates. Any document that proves ownership of a financial instrument.

Tasks

Death Certificates. You can obtain death certificates from vital statistics but typically a funeral home will order them for you. Death certificates are used to prove death and are useful for many legal and financial reasons.

Records and documentation. It is important that accurate records are kept of all bills paid, money deposited and spent, and every other transaction of the estate.

Forward Mail. Forward the mail with the Postal Service of any business or personal of your loved one. Review the mail regularly for any bills or other important documents.

Safe Deposit Box. Locate and inventory any safe deposit box that the deceased may have had.

Inventory Assets. Make a list of all assets. If necessary, obtain date of death valuations from banks and brokers.

Taxes. The estate may owe property and income taxes. The timing and valuation of assets can be important so talk to an attorney and a CPA before paying taxes.

Records and documentation. Because it is what most commonly gets people in trouble I'll say it again. It is important that accurate records are kept of all bills paid, money deposited and spent, and every other transaction of the estate.

This is an overview of the most common tasks that a personal representative needs to perform in Oregon. If you have any questions feel free to contact me or search the blog.

Compensation of Personal Representative in Oregon

Personal Representative Fee

In Oregon, the personal representative of a probate estate is entitled to compensations for the services provided to the estate. The personal representative must apply for the fee from the court. By statute, ORS 116.173, the compensation is based on the value of the estate.

Property subject to the Jurisdiction of the Court (Probate Property)

| Probate Property Value | Compensation |

|---|---|

| Less than $1000 | 7% |

| Above $1,000 and not exceeding $10,000 | 4% |

| Above $10,000 and not exceeding $50,000 | 3% |

| Above $50,000 | 2% |

Property not subject to the Jurisdiction of the Court (Non-Probate Property)

| Non-Probate Value | Compensation |

|---|---|

| All property, exclusive of life insurance proceeds, not subject to the jurisdiction of the court but reportable for Oregon inheritance or estate tax or federal estate tax purposes. | 1% |

Additional Compensation

The personal representative may be entitled to additional compensation "as is just and reasonable" that is extraordinary and unusual circumstances. The personal representative must request the additional compensation from the court.

Special Provisions in the Will

The Will of the estate that is being administered may have made a special provision for the compensation of the personal representative. In these situations, "the personal representative is not entitled to any other compensation for services unless prior to appointment the personal representative signs and files with the clerk of the court a written renunciation of the compensation provided by the will."

If you have any questions regarding the administration of an estate or how the probate process works, please search the blog or contact me.

Probating Joint Bank Accounts in Oregon

Who Gets the Money in the Joint Checking Account?

People often open a joint account with a child or caretaker so that they can help take care of bills and expenses as they age. This is typically done for convenience but once that person dies determining who owns the money in the account may not be as easy as you think.

Under ORS 708A.470, the sums remaining in a bank at the death of a party to a joint account are rebuttably presumed to belong to the surviving party. What this means in is that the child or caretaker on the account owns the remaining money but you may be able to fight it. Most people assume that the Will determines who receives the money in the account.

The rebuttable presumption under ORS 708A.470 may be overcome by evidence that the deceased party (1) intended a different result; or (2) lacked capacity when the joint account was established.

Although not as convenient as opening a joint account, there are many other ways to plan your estate so that you can be protected as you age. I've written about them here.

How much does Probate cost in Oregon?

One of the most common questions I am asked is how much the administration of a probate estate will cost the beneficiaries.

Probate Administration Costs

For 2016, the cost of filing for probate is $531 for the majority of estates. The court also charges an accounting fee and that is determined by the value of the estate. The public notice in the local paper runs between $100 and $500 depending on what part of Oregon you are filing in. If the person died without a Will, the court will normally require a bond. There may also be costs associated with selling property.

Probate Legal Fees

Attorneys' fees in Oregon are based on the number of hours billed and the lawyer's hourly rate. For the simplest of probates, the fees can be around $2000. In general, probate legal fees will run between $3,000 and $5,000. If the estate is large, complex or has unusual assets, the costs can be much higher. If the heirs and beneficiaries are fighting or if there is outside litigation involved, the costs can be much higher.

All legal fees for the probate administration must be approved by the court. Your probate lawyer will file with the court and with interested parties. The court will make a determination on whether the fees are reasonable in light of a narrative and itemized bill. This is a major protection for any beneficiary. Judges will see thousands of attorney fee statements during their careers and will know what is reasonable. Any interested party can object to fee and be allowed to speak the judge at a hearing.

If you have questions, please feel free to contact me below. I've also answered more questions on the Frequently Asked Question. You can also learn more about Oregon Probate on my practice area page.

Elements of an Oregon Estate Plan

What is Estate Planning?

There is much confusion about what estate planning is and what you actually need to do. I will go through some of the most common estate planning tools, how they work and when they are useful.

1. The Do-Nothing Option

This is probably the most common estate planning technique in Oregon and rarely is it ideal. If you die in Oregon without a will, your assets will be distributed by the laws of intestate succession. These laws are the Oregon Legislature's best guess of how most people would have wanted their assets divided among their heirs. Typically your assets will be inherited by your surviving spouse or equally among a class of heirs. If you are more interested, I have a full post dedicated to the common intestate scenarios linked here. You can also learn more about Oregon Probate on my practice area page.

2. Last Will and Testament

The basic Will is the simplest and most well known estate planning tool. They are generally assumed to have been invented in Ancient Greece around 600 BC. (Wikipedia has an article on the History of Wills.) At its simplest, a Will appoints someone to manage your estate after your death and provides them instructions on how to distribute your assets.

In Oregon you must have "testamentary capacity" in order to create a will. Testamentary capacity defined:

ORS 112.225 Who may make a willAny person who is 18 years of age or older or who has been lawfully married, and who is of sound mind, may make a will.

Now, there are several formalities that you have to follow in order have a duly executed will. I often hear complaints about these formalities. It is best to think about these formalities not as burdens but rather as quality control measures that make sure people don't steal from you after you die.

Oregon outlines the formalities of a duly executed Will in the ORS.

112.235 Execution of a willA will shall be in writing and shall be executed with the following formalities:

(1) The testator, in the presence of each of the witnesses, shall: (a) Sign the will; or (b) Direct one of the witnesses or some other person to sign thereon the name of the testator; or (c) Acknowledge the signature previously made on the will by the testator or at the testators direction. (2) Any person who signs the name of the testator as provided in subsection (1)(b) of this section shall sign the signers own name on the will and write on the will that the signer signed the name of the testator at the direction of the testator. (3) At least two witnesses shall each: (a) See the testator sign the will; or (b) Hear the testator acknowledge the signature on the will; and (c) Attest the will by signing the witness name to it. (4) A will executed in compliance with the Uniform International Wills Act shall be deemed to have complied with the formalities of this section.

There is much more to cover on the topic of Wills but this post is meant as an overview for estate planning.

3. Revocable Trusts

Sometimes marketed a "living trusts" or "loving trusts," a revocable trust is a contract with yourself that you can "revoke" if you change your mind. I've written about revocable living trusts in Oregon before but I will recap their uses here as well.

Many people have difficulty understanding how a revocable trust works so I've diagrammed it below.

The two most common uses for revocable trusts in estate planning are the avoidance of probate and conservatorship.

Avoiding Probate

The most common reason why probate proceeding are started in Oregon is because the titled property of the estate exceed the statutory amounts for small estate proceedings. (I will go into small estate proceedings later.) What that means in non-lawyer speak is that your home is worth more than $200,000. There are other ways to exceed the small estate limits but for most people it is the value of their home.

So, by placing your home and other assets into a revocable trust you can avoid probate all together or be able to settle your estate by Affidavit of Claiming Successor. When done properly, a revocable trust can avoid several thousand in probate administration fees and save months of time. Revocable trusts don't avoid estate taxes or shield assets from creditors. There are other tools that can be used to minimize taxes and protect assets and I will discuss those in a later post.

Avoiding Conservatorship

Conservatorship is a kind of protective proceeding in Oregon where the court appoints a conservator to manage the assets and finances of a protected or incapacitated person.

ORS 125.005 (3) defines financially incapable:

Financially incapable means a condition in which a person is unable to manage financial resources of the person effectively for reasons including, but not limited to, mental illness, mental retardation, physical illness or disability, chronic use of drugs or controlled substances, chronic intoxication, confinement, detention by a foreign power or disappearance. Manage financial resources means those actions necessary to obtain, administer and dispose of real and personal property, intangible property, business property, benefits and income.

As people aged they sometimes experience diminished mental capacity or conditions that make it difficult to manage their financial affairs. In these instances it may be necessary to go to court to establish a conservatorship and appoint a conservator. These can be expensive and time consuming proceedings so it is best to avoid them.

A revocable trust can avoid conservatorship by appointing a successor trustee if you become incapacitated. You can provide instructions in your trust on who you want to manage it and how you want it managed in the event you become incapacitated.

4. Advanced Medical Directives and POLST

For many people how they die is often more important than what happens to their belongings. I've written extensively on Advanced Medical Directives and Substituted Healthcare Decision Making before and how a person's faith influences medical decision making.

In a nutshell, Advanced Medical Directives allow you to appoint a Healthcare decision maker and leave instructions for end-of-life treatment. POLST (Physicians Orders for Life Sustaining Treatment) all you to decide what treatment you want if you have a terminal disease. I encourage all of my clients to complete their Advanced Medical Directives and POLST if they do no other estate planning. I will often hear from a family member who had to guess at their loved-one's desires for medical treatment in the ICU and are traumatized by the experience.

If you have any questions about Advanced Medical Directives, please follow the links above or leave a comment.

5. Virtual Asset Instruction Letter

This is a new area of estate planning that deals with virtual assets and how you would like them handled after your passing. For many of us the majority of our communications and photographs now exist on the servers of Google, Facebook, Apple and Microsoft. I wrote about this before (What is going to happen to your Facebook account when you die?) I've also written about Grieving Online.

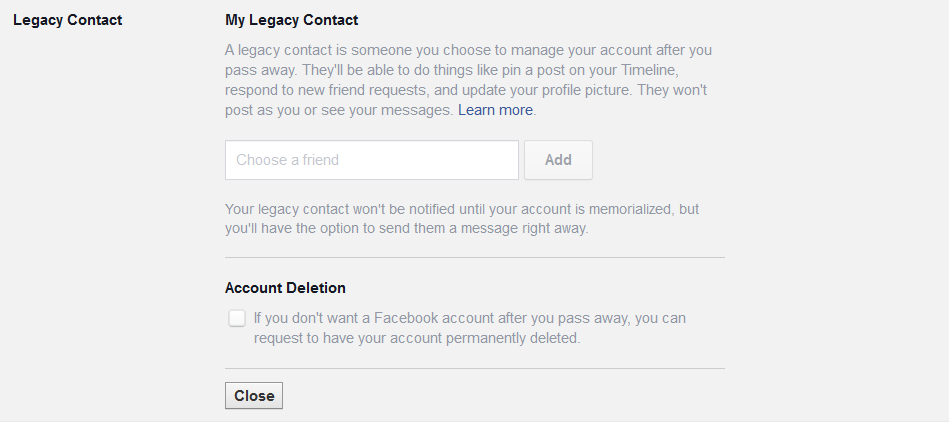

How these accounts are handled after your death depends on the Terms of Service of each of the companies. What is important is that you decide who you want to have access to these accounts and what you want them to do with them. Facebook allows you to add a legacy contact to manage your account or to delete your account after your death. Below is a snip from the Facebook Legacy Account Page. Other companies are creating similar programs to help you manage your accounts if you die.

The Virtual Asset Instruction Letter (VAIL) can work alongside your other estate planning documents and provide guidance to the person administering your estate. The VAIL can contain the passwords and logins for your accounts along with directions. Logins and access to financial institutions should be controlled by the Will or Trust but you may want to list them here as well but that is not what VAILs are typically designed to manage.

I would use a VAIL to give instructions about who you want to have copies of your emails or photos after your death. For example, you may have quite a bit of email correspondence with your grandchildren in a gmail account and you may want to provide copies of those emails to them.

For those of you who have monetized Youtube, Instagram or other accounts I would contact an estate planning attorney to advise you on the managing those accounts.

6. Beneficiary Designations and Payable on Death

Certain property does not need to pass through probate in order to be transferred to your heirs or devises. Most often this non-probate property are accounts that allow you designate a beneficiary. These accounts are basically contracts between you and the company holding your account. When you pass away the company will pay or allow access to the account without going through probate.

I explain beneficiary designations and non-probate property in more detail in a previous post. This most important thing to remember is to keep your beneficiary designations up to date and to review them regularly.

7. Specialty Trusts

There are many other specialty trust that are used in estate planning. The most common are Special Needs Trusts, Gun Trusts and Pet Trusts.

Special Needs Trusts

Special Needs Trusts are designed to hold property for a disabled person while at the same time allowing them to utilize government benefits. When creating a special needs trust, great care should be taken so that any government benefits under medicaid or SSI are not disrupted. I will discuss Special Needs trusts in more depth in a later post.

National Firearm Act Gun Trusts

These are trusts created to hold and purchase weapons regulated under the National Firearms Act. The purpose of a Gun Trust is to eliminate much of the burden of owning and transferring what are known as Title 2 devices (machine guns, sawed-off shotguns, grenade launchers, etc.) I think most of the marketing around gun trusts is based on fear mongering but there are some legitimate uses if you have NFA Firearms or a large/unique firearm collection.

Pet Trusts

A pet trust provides for the care of your pet if you are to die or become disabled.

Conclusion

I hope you have found this overview of common estate planning tools helpful. This is by no means an exhaustive list of options nor is it meant as advice for your situation.

If you have any questions please search the blog, contact me or leave a comment below. As always, please read the Disclaimer in the sidebar before commenting. It is there for your protection.

Faith Based Estate Planning in Oregon

Everyone that creates an estate plan wants it to be consistent with their beliefs whether they are religious or secular. In Oregon, any estate plan is enforceable so long as it complies with the requirements of Oregon law. The typical issues that of faith based estate planning are specialized inheritance rules and medical treatments. Some people may also wish to set money aside for faith based education and travel.

Faith Based Inheritance

If you pass away without a Will or and estate plan, your belongings will be distributed according to Oregon law. This "default plan" is called intestate succession and I have diagrammed common scenarios for inheriting property without a will in Oregon. These are the rules created by the Oregon Legislature and many faiths require a different distribution of property than that of the Oregon law.

For example, Surah An-Nisaa 4:11 says:

Allah instructs you concerning your children: for the male, what is equal to the share of two females. But if there are [only] daughters, two or more, for them is two thirds of one's estate. And if there is only one, for her is half. And for one's parents, to each one of them is a sixth of his estate if he left children. But if he had no children and the parents [alone] inherit from him, then for his mother is one third. And if he had brothers [or sisters], for his mother is a sixth, after any bequest he [may have] made or debt. Your parents or your children - you know not which of them are nearest to you in benefit. [These shares are] an obligation [imposed] by Allah . Indeed, Allah is ever Knowing and Wise.

In order to achieve a Shariah compliant estate plan, the distribution must be written into the will or trust documents. Many other faiths and traditions differ from the laws of intestate succession so don't assume that your wishes will be followed if you don't prepare a will.

End of Life Decision Making and Medical Care

The end of one's life is an ethically and morally fraught time for most people. Whether or not to use life sustaining treatment or to opt for treatment that may affect the unborn are concerns you may have when faced with a medical issue. Advanced Medical Directives allow you to specify what treatments you wish in these situations.

Using an advanced medical directive allows you to appoint someone to make medical decisions if you become incapacitated. You can also state whether or not you want to be connected to a ventilator or be provided other life sustaining treatments. Another tool used is the Physician Orders for Life Sustaining Treatment (POLST). You will need to complete your POLST with a physician and they will place it with your medical documentation.

Other common concerns are whether to donate organs or if you would like a spiritual leader to visit you in hospital. You may also want to provide instructions for burial or cremation.

Religiously based Incentive Trusts

These are trusts with strings attached to them. The religious education of your grandchildren may be important to you and you would like to set money aside for religious schooling. You may also want to place money in a trust to provide travel costs for the Hajj or religious pilgrimages to the Holy Lands when children or grandchildren marry or reach a certain age. Special care should taken when drafting incentives because the future is unknown and unforeseen consequences are common. Terms that are too harsh may cause resentment among your heirs and lead to the opposite of what you intended.

Work with and Educate your Estate Planning Attorney

Often times the attorney drafting your estate plan will not understand the religious requirements of your faith. If that is case you may want them to contact your faith leader to discuss the requirements. Of course you do not have to follow the guidance of any faith leader and are free to draft your last wishes however you want.

As with all estate planning, it is important that they understand your wishes when creating your documents so be sure to clearly communicate with your attorney and thoroughly review any document before signing it.

Search the blog and learn more about wills and probate in Oregon.

Disclaimer:

Nothing on this blog constitutes individual legal advice or creates an Attorney-Client relationship.

-

May 2023

- May 8, 2023 What is a Limited Judgment Appointing Personal Representative? May 8, 2023

- May 1, 2023 Where should I keep estate planning documents? May 1, 2023

-

April 2023

- Apr 24, 2023 How do I talk to my elderly parents about estate planning? Apr 24, 2023

- Apr 17, 2023 How do I get started in estate planning? Apr 17, 2023

- Apr 10, 2023 What questions should I ask my estate planning attorney? Apr 10, 2023

- Apr 5, 2023 Giving Appreciated Property to Charity in Oregon Apr 5, 2023

- Apr 3, 2023 How often should an estate plan or will be updated or reviewed? Apr 3, 2023

-

March 2023

- Mar 30, 2023 Is real property located outside of Oregon subject to the Oregon estate tax? Mar 30, 2023

- Mar 29, 2023 How do I find out who the personal representative of an estate is? Mar 29, 2023

- Mar 27, 2023 Why is estate planning so expensive? Mar 27, 2023

- Mar 23, 2023 Can non-residents be subject to the Oregon Estate Tax? Mar 23, 2023

- Mar 22, 2023 How do I sue a personal representative? Mar 22, 2023

- Mar 20, 2023 What are some estate planning steps that can ease financial burdens following the death of a loved one? Mar 20, 2023

- Mar 16, 2023 What is a credit shelter trust? Mar 16, 2023

- Mar 15, 2023 Who is the personal representative of an intestate estate? Mar 15, 2023

- Mar 13, 2023 How does a probate or personal representative bond work? Mar 13, 2023

- Mar 9, 2023 Does Oregon have a gift tax? Mar 9, 2023

- Mar 8, 2023 How can I leave money to my son but not his wife? Mar 8, 2023

- Mar 6, 2023 What is a power of attorney? Mar 6, 2023

- Mar 2, 2023 What is the importance of a schedule K-1 for an estate? Mar 2, 2023

- Mar 1, 2023 Overview of the Oregon Estate Tax Mar 1, 2023

- Mar 1, 2023 Oregon Estate Tax and the Fractional Formula Mar 1, 2023

- Mar 1, 2023 Can My Mother Leave Me Out of Her Will? Mar 1, 2023

-

February 2023

- Feb 27, 2023 What is a pour-over will? Feb 27, 2023

- Feb 24, 2023 How to remove squatters from a deceased person's home. Feb 24, 2023

- Feb 20, 2023 How can a revocable trust avoid a conservatorship? Feb 20, 2023

- Feb 17, 2023 A dead person owes me money, how do I file a claim? Feb 17, 2023

- Feb 16, 2023 What are the Oregon inheritance or succession laws? Feb 16, 2023

- Feb 13, 2023 What is a "revocable trust" or "living trust"? Feb 13, 2023

- Feb 6, 2023 Can property be transferred without probate? Feb 6, 2023

-

January 2023

- Jan 30, 2023 What happens to a bank account when someone dies without a beneficiary? Jan 30, 2023

- Jan 23, 2023 What is a Payable on Death bank account? Jan 23, 2023

- Jan 17, 2023 What happens if I don’t go through probate? Jan 17, 2023

- Jan 9, 2023 Does Oregon have a Transfer on Death deed? Jan 9, 2023

- Jan 2, 2023 What Triggers Probate in Oregon? Jan 2, 2023

- Jan 1, 2023 What is the 65 day rule for estates and trusts? Jan 1, 2023

-

May 2022

- May 10, 2022 Can a Will Avoid Probate? May 10, 2022

-

April 2022

- Apr 25, 2022 How Do You Avoid Probate in Oregon? Apr 25, 2022

- Apr 7, 2022 Must an Estate Go Through Probate in Oregon? Apr 7, 2022

-

March 2022

- Mar 28, 2022 How much does an estate have to be worth to go to probate in Oregon? Mar 28, 2022

-

September 2021

- Sep 3, 2021 We are closed for Labor Day. Sep 3, 2021

- Sep 2, 2021 How Long Does Probate Take in Oregon? (Updated for COVID) Sep 2, 2021

- Sep 2, 2021 How does probate work without a will in Oregon. Sep 2, 2021

-

January 2018

- Jan 18, 2018 2018 Oregon Estate Tax Rates Jan 18, 2018

- Jan 18, 2018 Is a Handwritten Will Valid in Oregon? Jan 18, 2018

-

December 2017

- Dec 18, 2017 Oregon Probate Fees in 2017 Dec 18, 2017

-

August 2017

- Aug 2, 2017 2017 Oregon Estate Tax Rates Aug 2, 2017

-

March 2017

- Mar 9, 2017 Oregon Probate Inventory Mar 9, 2017

-

November 2016

- Nov 26, 2016 Basics of an Oregon Estate Plan (Part 3) Nov 26, 2016

- Nov 8, 2016 Basics of an Oregon Estate Plan (Part 2) Nov 8, 2016

- Nov 1, 2016 Basics of an Oregon Estate Plan (Part 1) Nov 1, 2016

-

October 2016

- Oct 24, 2016 Duties of an Oregon Personal Representative Oct 24, 2016

-

September 2016

- Sep 6, 2016 Oregon Estate Planning Timeline Sep 6, 2016

-

June 2016

- Jun 23, 2016 How Long Does Probate Take in Oregon? Jun 23, 2016

- Jun 20, 2016 How to File for Probate in Oregon Jun 20, 2016

-

May 2016

- May 17, 2016 When is Probate required in Oregon? May 17, 2016

- May 6, 2016 Oregon Probate Bond May 6, 2016

- May 5, 2016 Oregon Personal Representative Checklist May 5, 2016

- May 3, 2016 Compensation of Personal Representative in Oregon May 3, 2016

-

April 2016

- Apr 29, 2016 2016 Oregon Estate Tax Rates Apr 29, 2016

- Apr 25, 2016 Probating Joint Bank Accounts in Oregon Apr 25, 2016

- Apr 19, 2016 How much does Probate cost in Oregon? Apr 19, 2016

-

March 2016

- Mar 3, 2016 What is a Guardianship in Oregon? Mar 3, 2016

-

February 2016

- Feb 26, 2016 Elements of an Oregon Estate Plan Feb 26, 2016

- Feb 24, 2016 Faith Based Estate Planning in Oregon Feb 24, 2016

- Feb 23, 2016 March Events Feb 23, 2016

- Feb 16, 2016 Self-Made Rich are more Generous Feb 16, 2016

- Feb 10, 2016 What Happens to assets if an Estate isn't Probated in Oregon? Feb 10, 2016

- Feb 8, 2016 Oregon Probate Jurisdiction Feb 8, 2016

- Feb 5, 2016 Do You Really Want to Die Rich? Feb 5, 2016

- Feb 4, 2016 2016 Oregon Legislation to watch Feb 4, 2016

- Feb 2, 2016 Probate Pitfalls (Investing Estate Assets) Feb 2, 2016

-

January 2016

- Jan 14, 2016 Intestate Succession in Oregon Jan 14, 2016

- Jan 13, 2016 Estate Planning for Unmarried Seniors Jan 13, 2016

- Jan 12, 2016 What does an Oregon Probate Attorney do? Jan 12, 2016

-

December 2015

- Dec 31, 2015 End of Life Decision Making in Oregon Dec 31, 2015

- Dec 21, 2015 Free Oregon Estate Planning Workshop Dec 21, 2015

- Dec 17, 2015 Non-borrowing surviving spouse can retain home subject to Reverse mortgage Dec 17, 2015

- Dec 3, 2015 Estate Planning for Digital Assets Dec 3, 2015

-

October 2015

- Oct 29, 2015 2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy Oct 29, 2015

- Oct 21, 2015 End of Year Estate Planning Oct 21, 2015

- Oct 12, 2015 Disinheriting Parents in Oregon Oct 12, 2015

- Oct 1, 2015 Inheriting Property when there is no Will. Oct 1, 2015

-

September 2015

- Sep 29, 2015 Negative Wills in Oregon Sep 29, 2015

- Sep 25, 2015 2016 Oregon Probate Law Modernization Sep 25, 2015

- Sep 21, 2015 The Probate Process in Oregon Sep 21, 2015

- Sep 15, 2015 2015 Oregon Estate Tax Rates Sep 15, 2015